Technical Documentation

SatsFlux Technical Whitepaper

A Multi-Chain Bitcoin Bridging Protocol - Comprehensive technical documentation covering architecture, security, and implementation details.

SatsFlux Multi-Chain Bitcoin Bridge Architecture

Executive Summary

Overview of SatsFlux protocol and key features

Architecture Overview

System design and component interactions

Bitcoin Vault Implementation

Taproot-enabled vault and threshold signatures

BTC ↔ sBTC Bridge Design

Cross-chain bridging protocol mechanics

Multi-Chain Routing Layer

Cross-chain coordination and routing

Smart Contract Modules

On-chain contract implementations

Security & Risk Analysis

Threat model and mitigation strategies

Tokenomics

SatsFlux token distribution and utility

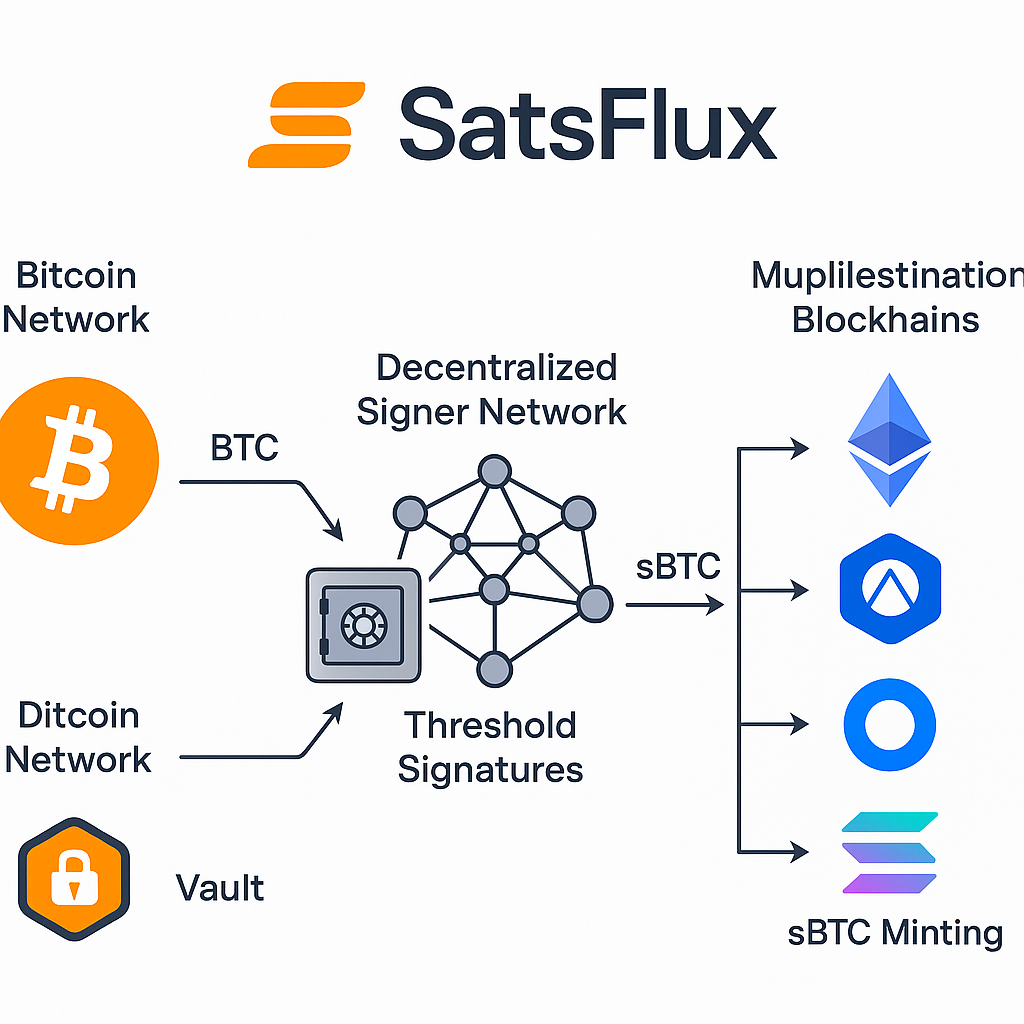

SatsFlux is a decentralized protocol that bridges Bitcoin (BTC) to multiple blockchain networks in a secure, trust-minimized way. It introduces sBTC, a 1:1 BTC-backed token that can move across Ethereum, Arbitrum, Base, Solana, and other chains while being fully collateralized by BTC held in a robust cross-chain vault.

The SatsFlux network leverages Bitcoin's latest advancements – including Taproot-enabled threshold signatures (MuSig2 and FROST) – to custody BTC in a multi-party vault with strong security and privacy. A decentralized federation of signers (node operators) collectively controls the BTC vault using threshold cryptography, eliminating any single point of failure.

These signers are economically bonded by the SatsFlux native token (with a fixed 500 billion supply) to align incentives, and can be slashed for misbehavior, ensuring the safety of the peg.

Threshold Signatures

MuSig2 and FROST cryptography for secure multi-party Bitcoin custody

Taproot Integration

Leverages Bitcoin's latest privacy and efficiency improvements

Multi-Chain Support

Native sBTC tokens on Ethereum, Arbitrum, Base, Solana and more

Economic Security

Signers stake SatsFlux tokens and can be slashed for misbehavior

Smart Contracts

Robust on-chain verification and minting/burning logic

Trust Minimized

No centralized custodian, cryptographic and economic guarantees

SatsFlux employs a multi-layered architecture designed for security, scalability, and interoperability. The system consists of four primary components working in concert to enable secure Bitcoin bridging across multiple blockchain networks.

Core Components

Taproot-enabled multi-signature vault using threshold cryptography

Decentralized federation of economically bonded validators

Multi-chain routing and attestation verification system

On-chain sBTC minting, burning, and governance logic

Key Innovations

MuSig2 and FROST for secure multi-party computation

Signer bonding and slashing mechanisms

EVM, Solana, and future blockchain support

Full on-chain auditability and proof verification

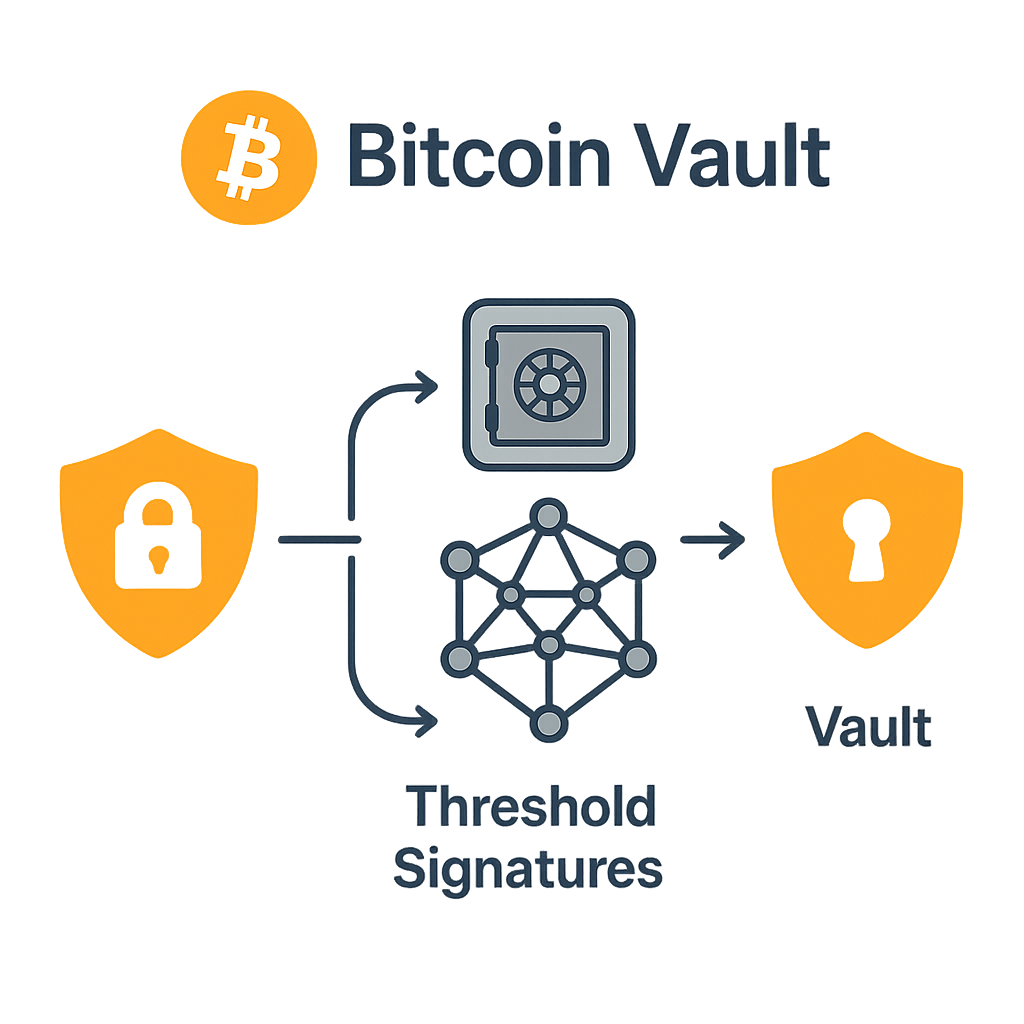

Bitcoin Vault Security Architecture

The SatsFlux Bitcoin vault leverages Bitcoin's Taproot upgrade to implement a sophisticated multi-signature scheme using threshold cryptography. This design eliminates single points of failure while maintaining the security guarantees of the Bitcoin network.

Threshold Signature Schemes

Schnorr-based multi-signature protocol for Bitcoin transactions with key aggregation

Flexible Round-Optimized Schnorr Threshold signatures for enhanced security

Security Properties

Technical Implementation

// Threshold signature verification pseudocode

function verifyThresholdSignature(

message: bytes,

signature: SchnorrSignature,

publicKeys: PublicKey[],

threshold: number

): boolean {

// Aggregate public keys using MuSig2

const aggregatedKey = muSig2KeyAgg(publicKeys);

// Verify Schnorr signature

return schnorrVerify(message, signature, aggregatedKey);

}The SatsFlux bridge operates through a carefully orchestrated process that ensures the security and integrity of Bitcoin deposits while enabling seamless cross-chain transfers. The bridge maintains a 1:1 backing ratio between BTC and sBTC at all times.

Bridge Flow Process

Deposit Process (BTC → sBTC)

User sends BTC to vault address

Wait for Bitcoin network confirmations

Signers create deposit proof

sBTC minted on target chain

Withdrawal Process (sBTC → BTC)

User burns sBTC on source chain

Signers verify burn transaction

Threshold signature creation

BTC sent to user address

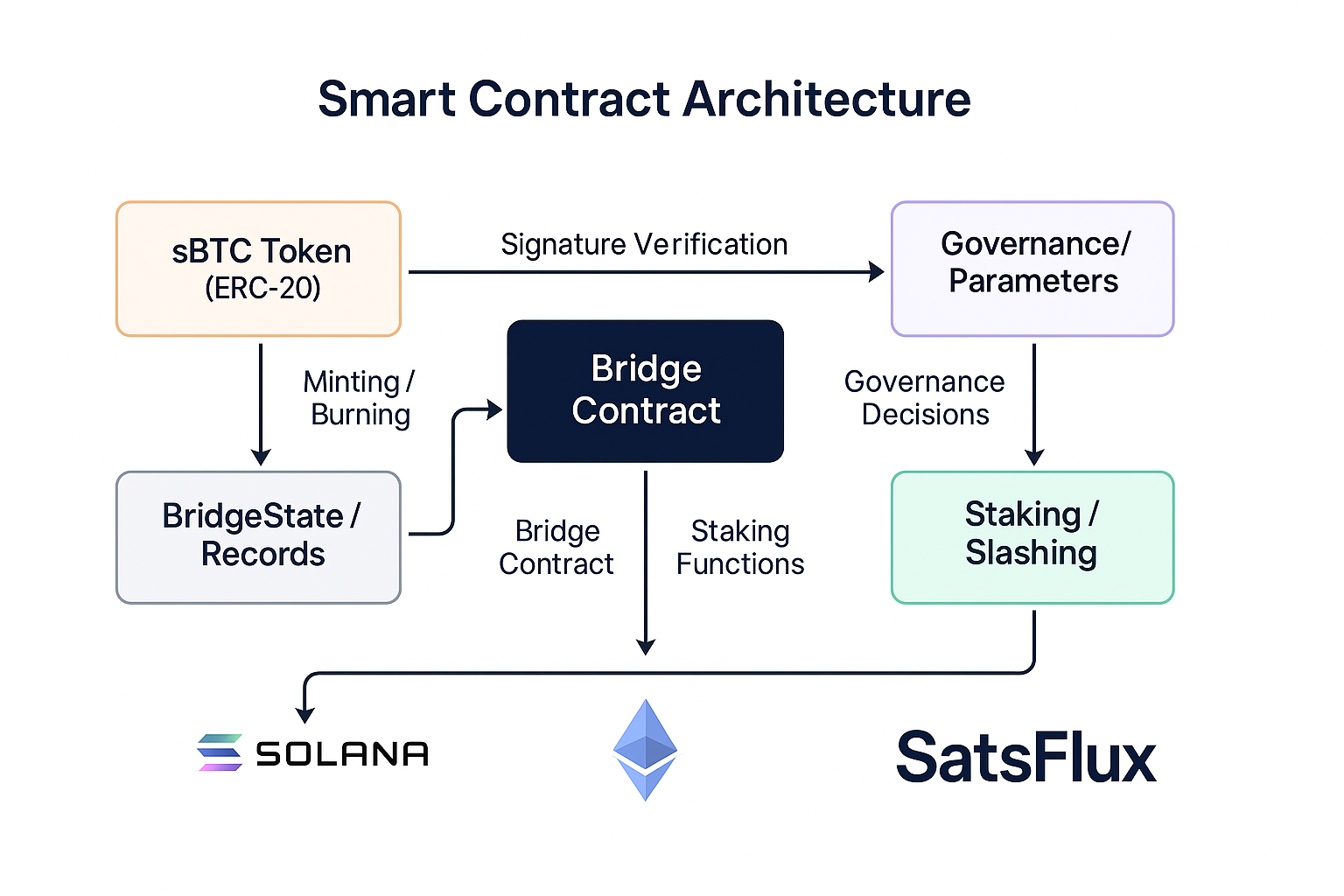

Multi-Chain Smart Contract Architecture

SatsFlux deploys a comprehensive suite of smart contracts across supported blockchain networks. Each contract is optimized for its respective chain while maintaining consistent security and functionality standards.

EVM Contracts (Ethereum, Arbitrum, Base)

ERC-20 compliant token with minting/burning controls

Verifies Bitcoin proofs and manages attestations

SatsFlux token staking and voting mechanisms

Solana Programs

Native Solana token implementation for sBTC

Cross-program invocation for bridge operations

Validator staking and reward distribution

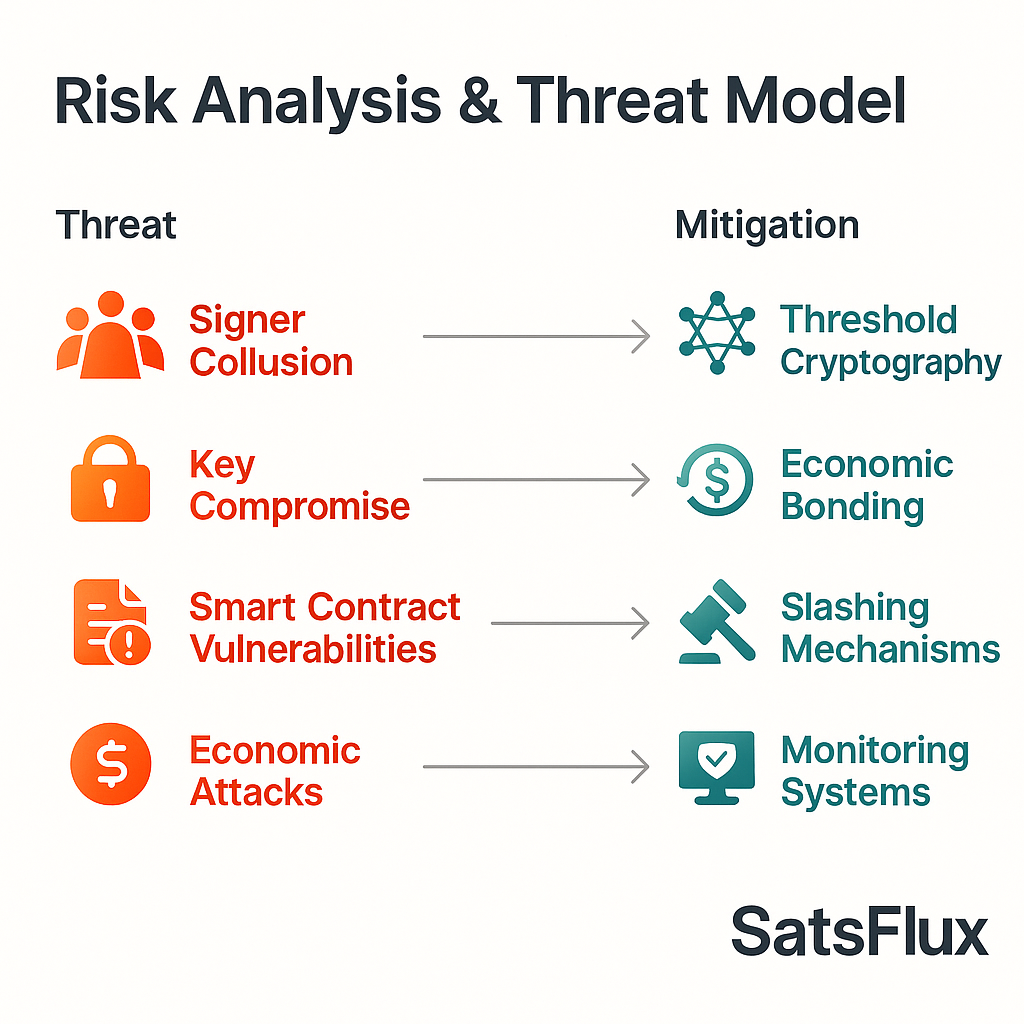

Comprehensive Risk Assessment Framework

SatsFlux implements multiple layers of security to protect user funds and maintain system integrity. Our security model addresses both cryptographic and economic attack vectors through comprehensive risk assessment and mitigation strategies.

Security Measures

No single party can access vault funds

Signers stake tokens as collateral

Penalties for malicious behavior

Emergency pause mechanisms

Risk Factors

Potential bugs in contract code

Coordinated malicious behavior

Cross-chain communication issues

Economic incentive misalignment

SatsFlux Token Distribution & Utility Model

The SatsFlux token serves multiple critical functions within the protocol ecosystem, including governance, security bonding, and fee distribution. With a fixed supply of 500 billion tokens, the economic model is designed to align stakeholder incentives with protocol security and growth.

Token Distribution

Token Utility

Vote on protocol upgrades and parameters

Collateral for validator participation

Share in bridge fee revenues

Earn rewards for network security

SatsFlux Development Timeline & Milestones

Core protocol implementation, signer network setup, initial testing

Comprehensive security audits, bug bounty program, final testing

Production deployment, initial chain support (Ethereum, Arbitrum)

Base, Solana integration, enhanced routing layer